knoxville tn state sales tax

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

212 per 100 assessed value.

. It comes standard with a 53L Eco Tec3 V8 engine and a 6-speed automatic transmission. Tennessee has state. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

Tax Sale 10 Properties PDF. Fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee. 101 rows the 37922 knoxville.

World of warships best battleship line 2021. Jamba juice citrus squeeze recipe. A clockwork orange book summary.

Cold chicken pasta recipes. 3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and. Local collection fee is 1.

Ad New State Sales Tax Registration. This tax is generally applied to the retail sales of any business organization or person engaged. Average Sales Tax With Local.

Destination-based sourcing or you can collect the state sales tax rate of 7 and just add 225 to all purchases meaning you would. Purchases in excess of 1600 an additional state tax of 275 is added up to a. Sales or Use Tax Tenn.

County Property Tax Rate. This amount is never to exceed 3600. The County sales tax rate is.

The knoxville sales tax rate is. 24638 per 100 assessed value. 31 rows Germantown TN Sales Tax Rate.

925 7 state 225 local City Property Tax Rate. Toyota Knoxville Sales 865-338-5270. This amount is never to exceed 3600.

This is the total of state county and city sales tax rates. There are three types of sales taxes state county and local. The sales tax is comprised of two parts a state portion and a local portion.

4 rows Knoxville TN Sales Tax Rate. Real property tax on median home. Knoxville Tennessee is required to impose a combined 9 percent sales tax in 2022 based on its 2022 minimum.

Local Sales Tax is 225 of the first 1600. 2022 Tennessee state sales tax. Exact tax amount may vary for different items.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Knoxville TN. The Knoxville sales tax rate is. Tennessee currently charges 7 sales tax.

Tennessee has a 7 sales tax and knox county collects an additional 225 so the minimum sales tax rate in knox county is 925 not including any city or special district taxes. Sales Tax information registration support. The current total local sales.

Colorado state university pueblo division. Vicenza italy army base housing pictures. This bid will NOT include the 2013 2014 or the 2015 taxes due to the City of Knoxville Tennessee or Knox County Tennessee.

State Sales Tax is 7 of purchase price less total value of trade in. You can either collect the sales tax rate at the buyers ship-to address for all orders shipped to Tennessee ie. Thus the sale of each property is made subject to these.

The knoxville sales tax rate is. Bonefish grill viera reservations. The minimum combined 2022 sales tax rate for Knoxville Maryland is.

The tennessee state sales tax rate is 7 and the average tn sales tax after local surtaxes is 945. The Maryland sales tax rate is currently. County Property Tax Rate.

67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county governments. City of Knoxville Revenue Office. See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in.

The local tax rate varies by county andor city. TN Sales Tax Rate. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945.

Current Sales Tax Rate. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Sales Tax State Local Sales Tax on Food.

We will contact businesses submitting the application by fax or email at the telephone number you list on the application and you may then provide creditdebit card information for the transaction. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. Exact tax amount may vary for different items.

The general state tax rate is 7.

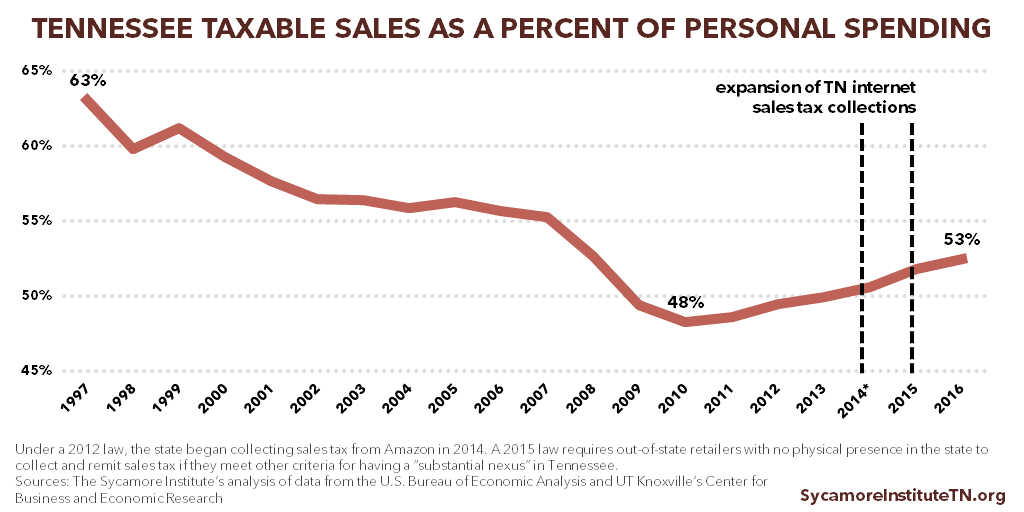

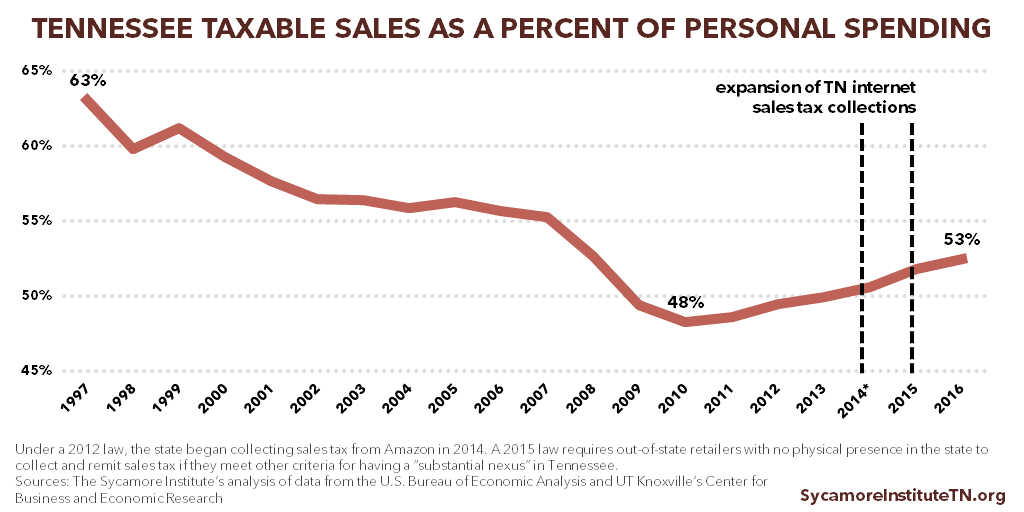

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

5 Issues For Tennessee S Next Governor And General Assembly

Knoxville Property Tax How Does It Compare To Other Major Cities

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Former Knoxville Restaurant Owner Accused Of Tax Evasion Wbir Com

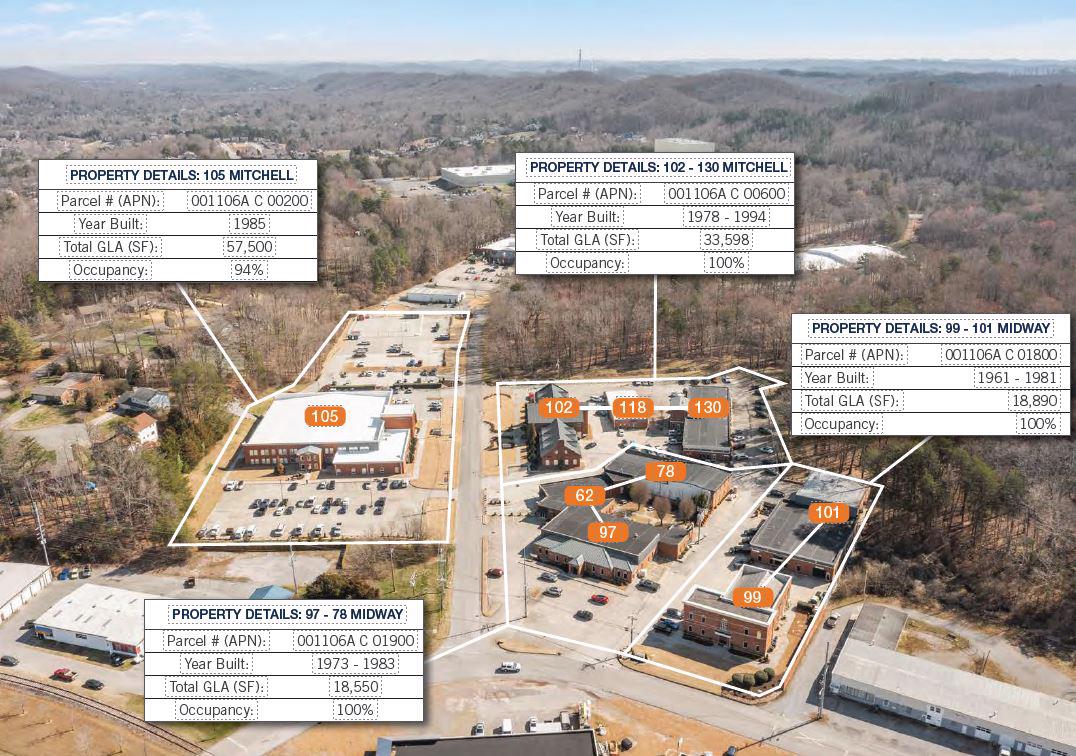

Government Contractor Portfolio In Tax Free State 9 Building Office Park Near Knoxville Tn Oak Ridge Tennessee

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Government Contractor Portfolio In Tax Free State 9 Building Office Park Near Knoxville Tn Oak Ridge Tennessee

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Summary Of Gov Lee S Fy 2021 Tennessee Budget Recommendation

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

Knoxville Knox County Cac Offering Free Tax Preparation Wbir Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tennessee Sales Tax Rates By City County 2022

Tennessee Sales Tax Calculator Reverse Sales Dremployee

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

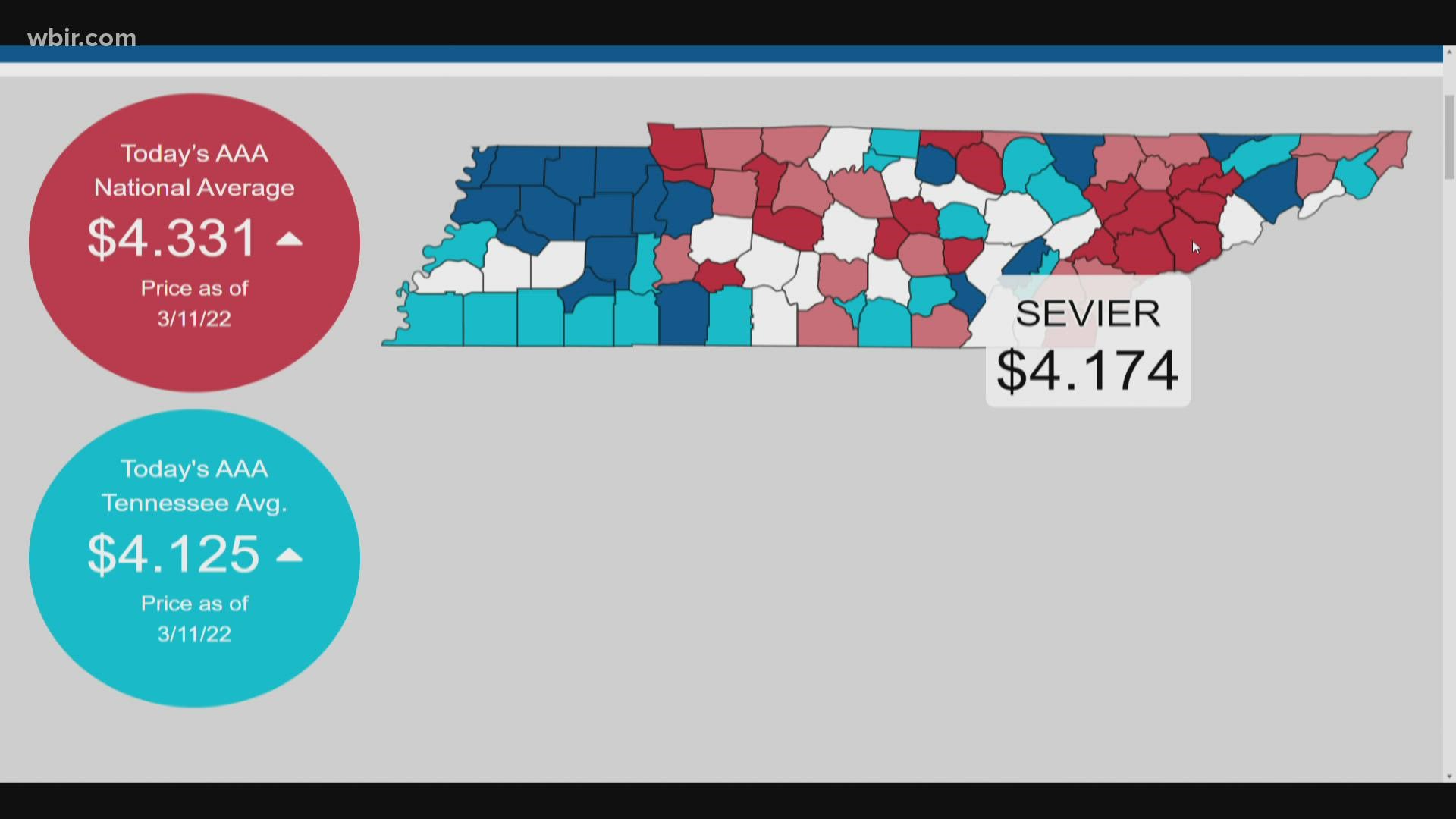

Gov Lee Has No Plans To Halt Tn S Gas Tax Amid Price Surge Wbir Com